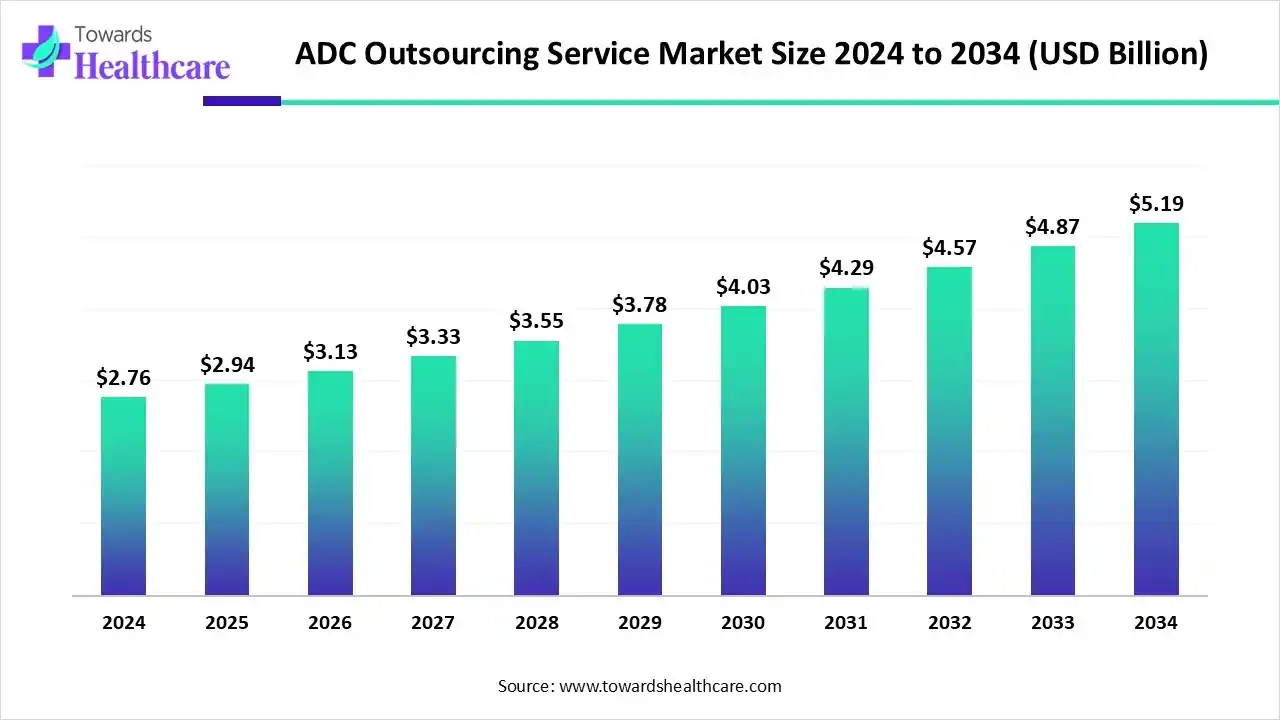

ADC Outsourcing Services Market Forecast: USD 2.94 Billion in 2025 to USD 5.19 Billion by 2034

The global ADC outsourcing service market size was valued at USD 2.76 billion in 2024 and is predicted to hit around USD 5.19 billion by 2034, rising at a 6.52% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 01, 2025 (GLOBE NEWSWIRE) -- The global ADC outsourcing service market size is calculated at USD 2.94 billion in 2025 and is expected to reach around USD 5.19 billion by 2034, growing at a CAGR of 6.52% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6339

Key Takeaways

- ADC outsourcing service sector pushed the market to USD 2.76 billion by 2024.

- Long-term projections show a USD 5.19 billion valuation by 2034.

- Growth is expected at a steady CAGR of 6.52% in between 2025 to 2034.

- North America was dominant in the market share by 45% in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR in the upcoming years.

- By type, the CRDMO (Contract Research, Development, and Manufacturing Organization) segment held a major share of the market in 2024.

- By application, the pharmaceutical companies segment dominated the ADC outsourcing service market in 2024.

- By application, the biotechnology companies segment is expected to be the fastest-growing during 2025-2034.

- By end service stage, the conjugation & linker-payload development segment led the market in 2024.

- By end service stage, the HPAPI/cytotoxin manufacturing segment is expected to witness rapid expansion in the studied years.

Ongoing Substantial Investments: How Does it Impact the ADC Outsourcing Service?

Particularly, many firms are contracting out the expansion and manufacturing of ADCs, which are complex cancer-fighting drugs, to specialized third-party providers (CDMOs) is considered as ADC outsourcing service market. The increasing need for specialized expertise and infrastructure for highly potent active pharmaceutical ingredients (HPAPIs), an immersive breakthrough in ADC technology, with accelerated FDA and EMA approvals, is propelling the overall progression.

Furthermore, certain giant pharmaceutical companies, such as AstraZeneca, are actively stepping into heavy investment in the development of their own internal ADC production capabilities. Alongside, CDMOs are fostering highly advanced linker technologies to optimize the activity of ADCs, like the application of more hydrophilic linkers and "branch linkers" to modulate drug loading.

What are the Drivers in the ADC Outsourcing Service Market?

The market is primarily driven by the rising need for specialized infrastructure and stricter adherence to regulatory guidelines in the complex, multi-step production of ADC. As well as many companies are developing essential facilities for ADC production is fueling significant investment, which ultimately demands outsourcing to specialized contract development and manufacturing organizations (CDMOs).

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What are the Key Trends in the ADC Outsourcing Service Market?

- In November 2025, Samsung Life Science Fund, a collaborative initiative among Samsung C&T, Samsung Biologics, Samsung Bioepis, and handled by Samsung Ventures, invested in Phrontline Biopharma for the development of a new generation of antibody-drug conjugates (ADCs).

- In October 2025, LOTTE BIOLOGICS (CEO James Park) and SK pharmteco (CEO Joerg Ahlgrimm) signed a Letter of Intent (LOI) to boost their competitiveness in the global antibody-drug conjugate (ADC) market.

- In October 2025, Invenra Inc. and Xcellon Biologics collaborated to expand bispecific and trispecific antibody-drug conjugate (ADC) development.

What is the Major Challenge in the ADC Outsourcing Service Market?

Specific challenges in the respective industry are improving the drug-to-antibody ratio (DAR), linker stability, and payload potency, while supply chain issues stem from the requirement for highly specialized facilities, potential capacity constraints at CDMOs.

Regional Analysis

Why did North America Dominate the Market in 2024?

By capturing the largest share of 45%, North America registered dominance in the market in 2024. A prominent catalyst is the presence of many pharmaceutical & biotechnology key players, with an escalated pipeline of a variety of ADCs in research and development. The US trend is shifting towards integrated, one-stop-shop manufacturing services, which lowers the complexity and delays connected with working with multiple service providers.

For instance,

- In June 2025, NextCure, Inc., and Simcere Zaiming partnered to establish SIM0505, a new antibody-drug conjugate (ADC) targeting CDH6 (cadherin-6 or K-cadherin) for the treatment of solid tumors.

What Made the Asia Pacific Grow Significantly in the Market in 2024?

In the prospective period, the Asia Pacific is anticipated to register rapid expansion in the ADC outsourcing service market. A rise in the geriatric population, which is highly prone to chronic diseases, is bolstering the need for advanced and targeted therapies, which ultimately demand robust manufacturing and specialized expertise. For the faster innovations, & approvals, governments of China, India, and South Korea are pushing significant initiatives and funding policies for R&D.

For instance,

- In October 2025, Piramal Pharma Solutions signed a Memorandum of Understanding (MOU) with IntoCell Inc. to advance its strategic alliance and implement groundbreaking antibody-drug conjugate (ADC) linker and payload platform technologies.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By type analysis

Which Type Led the ADC Outsourcing Service Market in 2024?

In 2024, the CRDMO (Contract Research, Development, and Manufacturing Organization) segment registered dominance in the market. A major driver is that it can handle the complete drug lifecycle, i.e. from early discovery to commercial manufacturing under one roof. Also, they offer access to multidisciplinary scientific teams, specialized high-containment facilities, and cutting-edge equipment for each biotech company.

By application analysis

Why did the Pharmaceutical Companies Segment Dominate the Market in 2024?

The pharmaceutical companies segment captured a dominant share of the ADC outsourcing service market in 2024. Specifically, the market is exploring integration of contract development and manufacturing organizations (CDMOs) to facilitate end-to-end services, crucial planned partnerships (like Samsung Biologics with LegoChem Biosciences and Simtra with Merck KGaA), and vital investments in enhancing production capabilities, especially new facilities for both large and small players.

On the other hand, the biotechnology companies segment will expand rapidly. Prominently, CDMOs are increasingly offering the growth of new branch linkers that allow better drug loading and expanded ADC performance to these companies. Besides this, outsourcing services are fostering innovation over the conventional models with the progression of bispecific ADCs (targeting two or more proteins), dual-payload ADCs, and immune-stimulating ADCs.

By end service stage analysis

Which End Service Stage Dominated the ADC Outsourcing Service Market in 2024?

The conjugation & linker-payload development segment accounted for the largest share of the market in 2024. A rise in the utilization of developed antibodies for better conjugation uniformity, advances in newer linker-payload combinations to boost stability and release, are impacting the segmental expansion. Alongside the market is exploring integrated, technology-driven platforms for both the prospective transformation and production.

Whereas the HPAPI/cytotoxin manufacturing segment is anticipated to grow rapidly. Mainly, because of the capital-intensive nature and specialized containment necessities, many of the pharmaceutical companies are preferring outsourcing of manufacturing to experienced Contract Development and Manufacturing Organizations (CDMOs). More specifically, various CDMOs are persistently investing in advanced barrier isolation technology and containment systems (such as OELs down to single-digit nanograms per cubic meter) to ensure personnel safety and product integrity.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

What are the Key Developments in the ADC Outsourcing Service Market?

- In November 2025, BioDlink, a major biologics CDMO, together with Lepu Biopharma, launched MEIYOUHENG (Becotatug Vedotin injection), the world’s first EGFR-targeting antibody-drug conjugate (ADC).

- In October 2025, Syngene International, a global contract research, development and manufacturing organisation (CRDMO), introduced a GMP bioconjugation suite at its commercial biologics facility (Unit 3) in Bengaluru, to facilitate fully integrated, end-to-end services for antibody-drug conjugates (ADCs).

- In May 2025, Merck and Daiichi Sankyo unveiled a global phase III trial of a novel antibody drug conjugate in advanced oesophageal squamous cell carcinoma.

ADC Outsourcing Service Market Key Players List

- Charles River Laboratories

- IQVIA

- Evotec SE

- WuXi AppTec

- Parexel

- PPD, Inc.

- ICON plc

- Theorem Clinical Research

- Baxter BioPharma Solutions

- Merck/SAFC

- Piramal Pharma Solutions

- Covance (Labcorp)

- Syngene

- Lonza Group AG

Browse More Insights of Towards Healthcare:

The global outpatient blood pressure monitoring equipment market size is estimated at US$ 1.38 billion in 2025, is projected to grow to US$ 1.50 billion in 2026, and is expected to reach around US$ 3.14 billion by 2035. The market is projected to expand at a CAGR of 8.56% between 2026 and 2035.

The asthma and COPD medicines market size was valued at US$ 13.10 billion in 2025 and is projected to grow to 13.62 billion in 2026. Forecasts suggest it will reach approximately US$ 19.32 billion by 2035, registering a CAGR of 3.96% during the period.

The global hospital outsourcing market size is calculated at US$ 381.74 in 2024, grew to US$ 421.21 billion in 2025, and is projected to reach around US$ 1021.17 billion by 2034. The market is expanding at a CAGR of 10.34% between 2025 and 2034.

The global GMP peptides market size is calculated at USD 1.3 billion in 2024, grew to USD 1.41 billion in 2025, and is projected to reach around USD 2.9 billion by 2034. The market is expanding at a CAGR of 8.35% between 2025 and 2034.

The sports medicine market is anticipated to grow from USD 6.69 billion in 2025 to USD 11.90 billion by 2034, with a compound annual growth rate (CAGR) of 6.6% during the forecast period from 2025 to 2034.

The global marine pharmaceuticals market size is calculated at US$ 6.19 billion in 2024, grew to US$ 6.52 billion in 2025, and is projected to reach around US$ 10.34 billion by 2034. The market is expanding at a CAGR of 5.29% between 2025 and 2034.

The AI in biopharmaceuticals market size is calculated at US$ 1.55 billion in 2024, grew to US$ 2.05 billion in 2025, and is projected to reach around US$ 24.49 billion by 2034. The market is expanding at a CAGR of 32.27% between 2025 and 2034.

The global microRNA market was estimated at US$ 2.31 billion in 2026 and is projected to grow to US$ 6.89 billion by 2035, rising at a compound annual growth rate (CAGR) of 12.89% from 2026 to 2035.

The blood bank (blood banking) market was estimated at US$ 17.33 billion in 2023 and is projected to grow to US$ 25.77 billion by 2034, rising at a compound annual growth rate (CAGR) of 3.7% from 2024 to 2034.

Segments Covered in the Report

By Type

- CRDMO (Contract Research, Development, and Manufacturing Organization)

- Other Service Providers

By Application

- Pharmaceutical Companies

- Biotechnology Companies

By End Service Stage

- Conjugation & Linker-Payload Development

- HPAPI/Cytotoxin Manufacturing

- Analytical & Stability Testing

- Fill-Finish & Packaging

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6339

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.